It seems the bear market is back with a vengeance, and many investors are scrambling to make the right moves to protect their portfolios. To many, the market looks like a ticking time bomb poised to explode. While this may be true, there are some important steps that investors can take to ensure they minimise their losses during tumultuous market cycles.

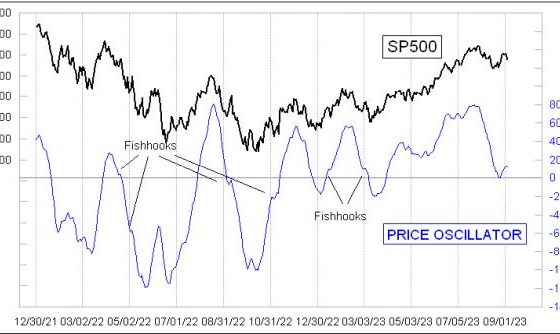

The concept of a “Technical Correction” is one way for traders and investors to manage their portfolios during market downturns. A ‘Technical Correction’ occurs when the prices within a larger trend move away from the established trend and then subsequently returns. In the case of Bear markets, investors can look to Technical Corrections as an opportunity to buy low and sell high as prices return to the originating trend.

The concept of ‘Technical Corrections’ depends on the unique market sentiment at the time, as well as the specific instrument being traded. For example, the preferred stock ETF (exchange-traded fund) SPY (Standard & Poor’s 500 tracker) will often witness a “Technical Correction” during bear markets as the index shifts between over-valued and under-valued states. These Technical Corrections should be seen as buying opportunities for value-focused investors.

This makes the current bear market an exciting opportunity for many investors to take advantage of the low prices and prepare for the return to long-term growth. Amidst the uncertainty of the market conditions, it’s important to retain a focus on fundamentals. Technical Corrections can help investors to maintain their cool-headed approach to the markets rather than getting overly caught up in the volatility of the short-term.

The concept of the ‘Technical Correction’ is an excellent tool for investors to rise above the current market sentiment and embrace an opportunity to make profits during times of market turbulence. As the bear markets return, keeping a close eye on how ‘Technical Corrections’ could help investors to seize the opportunity ahead.