When it comes to investing, many people can easily get caught up in the moment and focus solely on short-term gains. While it’s understandable to be drawn to investing strategies that provide quick returns, it’s important to also remember the importance of taking a long-term approach when it comes to investing in bonds.

Bonds are a great way to protect your assets while earning a consistent income. While stock markets can be volatile and unpredictable, bonds tend to be relatively stable. This means that while stock prices may jump around from day to day and month to month, the returns on bonds often remain consistent throughout the long-term.

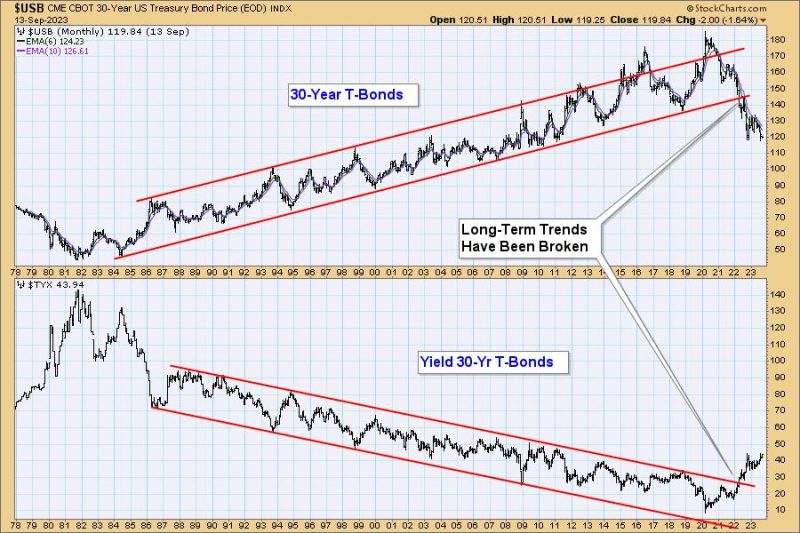

The long-term trend in bonds is more predictable than most other investments. So if you’re looking to invest in something with low volatility, bonds should be on the top of your list. Of course, this doesn’t mean that you will make a significant amount of money right away; however, over time, the returns on bonds have the potential to be quite rewarding.

The key to success when investing in bonds is to remember the long-term trend. While it may be tempting to try to take advantage of short-term market fluctuations, investing in bonds with a long-term mindset can provide stability and consistent income over the years.

Investors should also remember that bonds are not completely immune to market conditions. Even though bonds have the ability to provide a steady return, they can still be affected by major events. Therefore, it’s important to research the bond market and watch for shifts in its behavior.

Therefore, an important takeaway is to remember that bonds should be an integral part of anyone’s portfolio. With the ability to provide a stable and consistent income, bonds can act as a buffer against unpredictable markets and provide a reliable base for investors to build upon.