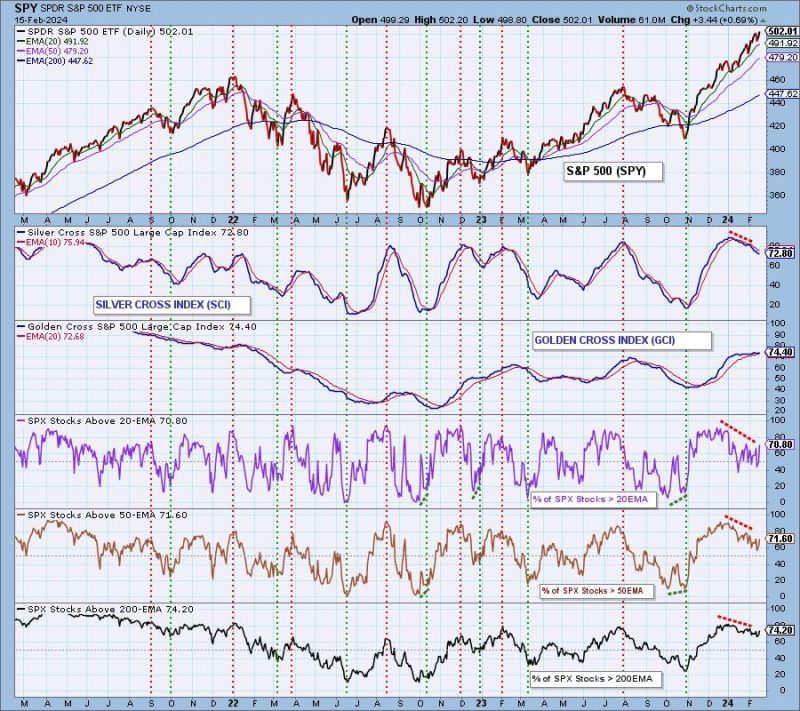

As market trends continuously undergo critical evolutionary changes, the BUY signals continue to face escalating diminishment. The essence of these BUY signals in the financial market cannot be overstated; these are the green-lights that inform investors when to purchase stocks or securities to optimize their investment strategies. However, recent observations suggest a prevalent trend of BUY signals dwindling, sending ripples across the financial landscape.

In understanding this phenomenon better, one must first grasp the role BUY signals play in investing and trading. BUY signals are typically derived from technical indicators or analysis that suggest an upward trend in a stock’s or security’s price. They aim to help investors make informed decisions, thus minimizing risk and optimizing returns. In theory, these signals should be abundant and easily identifiable. But, what happens when these signals begin to diminish?

One primary driver of depleted BUY signals is a volatile and uncertain market. External factors such as political instability, economic downturns, or global health crises can drastically affect market sentiment and stability, thereby negatively impacting the generation of BUY signals. In these periods of market turbulence, even experienced investors may find it difficult to identify promising BUY signals.

A second key factor is the increasing prevalence of algorithmic trading. In this type of trading, complex algorithms analyze market data to execute trades at high speed. While this model provides advantages in terms of speed and accuracy, it also means that BUY signals can be swiftly capitalized on before individual investors realize their presence. This swift action leaves fewer BUY signals identifiable to the human eye, thereby reducing their overall presence in the market.

The diminishing nature of BUY signals may also be attributed to the upsurge of passive investing. Passive investing essentially involves building a portfolio and remaining relatively inactive, rather than attempting to beat the market through active buying and selling. This investment strategy typically depends less on active BUY signals, which could be contributing to their overall reduction.

Moreover, the influx of inexperienced or casual investors into the market can lead to misinformation or misunderstanding about BUY signals. With the rise of easy-to-use trading platforms and apps, a larger number of novice investors are jumping into the market without necessarily understanding the intricacies behind BUY signals, thereby diluting their fundamental importance.

However, a dwindling of BUY signals does not necessarily mean disaster for investors. Instead, it encourages reevaluating investment techniques and strategies to adapt to this changing landscape. It promotes the challenge to evolve static investment methods towards more adaptive, fluid approaches that can excel even in periods of low BUY signals.

Rather than seeing this phenomenon as a road-block, investors can use it as an opportunity to diversify their investment methods and strategies, focusing more on fundamental analyses, long-term investments, and other such techniques that do not rely heavily on BUY signals. Additionally, education regarding market trends, signals, and investment strategies should be increased to ensure that both new and experienced traders understand and can effectively navigate this dynamic financial environment.

Overall, the shrinking presence of BUY signals is a reflection of the evolving marketplace and shifts in investment strategies. As these signals continue to diminish, investing’s challenge and reward lie in the ability to adapt and innovate in an ever-changing financial landscape.