Understanding the Basics: The Average True Range (ATR) Trailing Stop

The Average True Range or ATR is a technical analysis indicator developed by J. Welles Wilder Jr. It essentially measures volatility in the market by calculating the degree of price variation over a specified time period. In its simplest form, the ATR aids individuals in deciding what trade to hold or dispose of in the stock market.

The ATR Trailing Stop primarily functions as a trend-spotting tool. It assesses the current price in relation to the historical price range, while the ATR value identifies the average trading range of specific security. This information plays a crucial role in informing individuals whether to maintain a hold on their trade or close their position.

Embarking on the Trade: Applying the ATR Trailing Stop

To use the ATR Trailing Stop, it’s necessary first to determine the ATR value for the specific security being traded. While the default setting for the ATR period is typically 14 bars, investors can modify this value to fine-tune the sensitivity of the ATR Trailing Stop. Less bars equates to higher sensitivity, meaning more fluctuations and vice versa.

The ATR value is then leveraged to mark the stop-loss level. For example, if the ATR value is 1.5, investors would likely draw their stop-loss line 1.5 points below the current price for a long trade or 1.5 points above for a short trade. Thus, tailoring the stop-loss value to the security’s typical price swings helps minimize premature exits due to normal market movements.

Determining the Trend: Reading the ATR Trailing Stop Signals

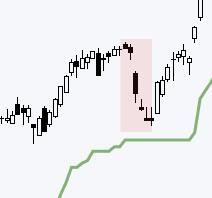

The ATR Trailing Stop has the ability to not only manage the trade but also to define the trend. The principle is straightforward: if the price is above the ATR Trailing Stop value, the market trend can be considered bullish, or up. Conversely, if the price falls below the ATR Trailing Stop value, the trend is perceived to be bearish, or down.

Shifts between uptrends and downtrends are marked by a change in the position of the ATR Trailing Stop. This transition helps traders distinguish between choppy market conditions and genuine trend changes. However, it’s important to note that all financial indicators, including the ATR, should not be used in isolation for decision-making. Combining them with other tools and techniques can provide a more holistic analysis of market behavior.

Enjoying the Benefits and Acknowledging the Flaws

The ATR Trailing Stop is widely appreciated for its adaptability to changing market conditions. Unlike fixed units or percentages, the ATR Trailing Stop adjusts to the specific security’s volatility, offering more dynamic stop-loss placement. However, it’s vital to acknowledge that the ATR Trailing Stop may have shortfalls during periods of low volatility or sharp price gaps.

In a nutshell, the ATR Trailing Stop is a flexible and multifunctional tool that could notably enhance an investor’s trading strategy by allowing for better risk management and accurate trend identification. Acknowledging its strengths and weaknesses is key to tailoring it to one’s individual trading style and preferences. Ultimately, understanding and implementing technical analysis tools like the ATR Trailing Stop can contribute positively towards more informed and strategic trading decisions.