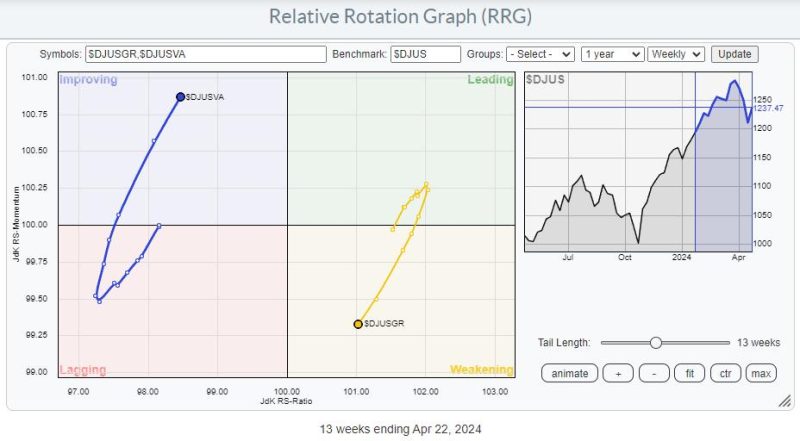

As the investing landscape continues to evolve in real-time, there has been a remarkable shift in the dynamics of the market. Notably, value stocks are beginning to outpace their growth counterparts – a significant development that raises the potential of a 10% downside risk for stocks.

The market’s recent transition from growth to value has been spurred on by several critical factors. One of the most impactful of these is the rise in treasury yields. As rates creep up, money usually rotates from growth stocks into value, given their comparative advantage in a higher interest rate environment. This pattern is now playing out as the U.S. 10-year Treasury yield keeps moving north from their historically low levels of 2020.

Another element influencing this dynamic is the escalating optimism for economic recovery. Many investors are betting on the cyclical stocks typically held within the value sector, forecasting a robust bounce back from pandemic-era lows. Industries including financials, energy, and industrials are part of this category, and they sprang to life as vaccination rates saw uptrends and economic activities resumed.

A more granular look into the specifics of the market movement reveals that the recovery optimism has been particularly beneficial to small-cap value stocks. Historical data indicates that these stocks lead markets higher coming out of a recession, coinciding with the current situation in the global economy. This correlation can be attributed to the fact that small-cap companies are typically domestically focused, thus more responsive to changes in the domestic economy than multinational organizations are.

Amidst these market shifts, investors would do well to heed the implications of a potential drop in stocks. The potential downside risk of approximately 10% in the broad equity market is hinging on the success of the value sector. If economic recovery does not proceed at the expected pace, sectors like energy and financials might take a hit, affecting the performance of value stocks as a whole.

The reversed market dynamics also signals potential risks for growth stocks. The lofty valuations these stocks had enjoyed during the pandemic-induced market might be shortened if inflation expectations intensify and interest rates continue to rise. Therefore, investors heavily vested in growth constituents might need to brace themselves for risk.

The tech sector, traditionally a home for growth stocks, could be particularly vulnerable. Major tech players’ valuations have been stretched due to the increased demand for digital services during lockdowns. If bond yields continue to rise, forcing a rotation out of growth, tech stocks will likely experience a downturn.

Several strategies may help fortify an investment portfolio against these potential risks. Diversification of the portfolio to include both growth and value stocks can provide a protective buffer. Additionally, focusing on companies with strong fundamentals rather than getting enticed with momentum plays, especially in periods of volatility, can make for wise investing.

In conclusion, although the onset of a new phase distinctly dominated by value stocks might foster resilience in the market, it may not be devoid of potential downsides. A 10% downside risk for stocks looms on the horizon as value takes the lead, prompting investors to keenly monitor market trends and adjust their strategies accordingly.