The S&P 500 (commonly referred to by its trading symbol, SPY) is an attractive trading option for investors given its broad appeal and market capitalization. It’s a bundle of diverse stocks, providing wholesale coverage of the market. Deciding the appropriate time to buy or sell is crucial and monitoring pullbacks plays a significant role in this decision-making process.

Spotting Pullbacks

A pullback refers to a temporary reversal of the long-term trend, generally a movement of about five to twenty-five percent. Pullbacks present an opportunity for investors to buy an asset at a discounted price before it surges back up again. Investors, therefore, need to identify when a pullback is over to maximize return on investment.

In SPY, pullback analysis is carried out by focusing on fundamental analysis, technical analysis, market sentiment, and macroeconomic indicators.

Fundamental Analysis

Fundamental analysis entails a thorough examination of the overall health of the economy. This includes analysis of earnings, expenses, assets, and liabilities. It is an important way to evaluate a company’s intrinsic value and potential for future growth. Investors should be on the lookout for positive fundamental indicators to know when a pullback is about to end. A high P/E ratio, steady revenue growth, and high return on equity are some of the indicators of a promising future performance.

Technical Analysis

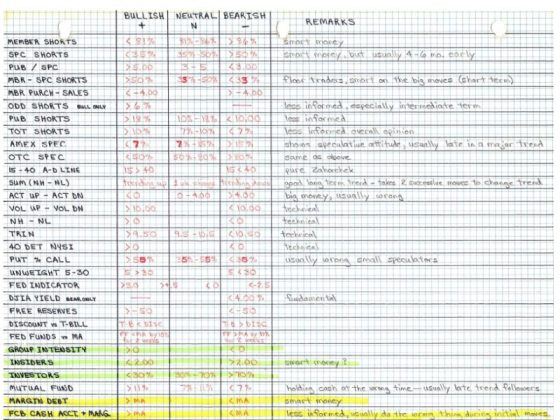

Technical analysis involves studying statistical trends gathered from trading activity such as price movement and volume. Several patterns and indicators signal when a pullback might be near its end. These include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. A low RSI often indicates an oversold condition that might signal the end of a pullback. On the other hand, the MACD can show when the asset’s momentum is slowing down, indicating the possible end of the pullback, while the tightening of the Bollinger Bands can indicate a forthcoming change in direction.

Market Sentiment

Market sentiment, also commonly referred to as investor sentiment, plays a crucial role in knowing when the pullback is over. Extreme pessimism often signifies that a rebound is imminent. Bullish investors might see this as an opportunity to buy, while bearish investors see it as a sign to sell. A good investor keeps tabs on investor sentiment through market surveys and put/call ratios.

Macroeconomic Indicators

Macroeconomic indicators like employment figures, GDP, interest rates, and inflation reportedly also influence pullbacks. Significant positive changes in these variables can signal a potential end to a pullback. For instance, a decrease in unemployment or an increase in GDP can predict a bullish result for SPY.

Drawing Conclusions from Each Analysis

Pullback analysis can significantly enhance decision-making in trading. By incorporating fundamental analysis, technical analysis, market sentiment, and macroeconomic indicators, investors can gain a full perspective on a pullback’s potential end. A combination of a favorable financial condition, positive graph trends, bullish market sentiment, and healthy macroeconomic indicators can most likely predict the end of a pullback, thus giving a green signal for the investors to invest in.

Each investor may weigh each analytical tool differently according to their personal trading style. However, using this combination of analyses to study the various factors influencing the SPY can provide invaluable insights into the timing of investment decisions, boosting potential returns.

Risk Management

Despite this profound analysis, market predictions cannot be 100% accurate and come with risks. Investors must, therefore, always account for potential downturns while trading. This can be done by setting stop loss orders to limit potential losses and diversifying one’s portfolio.

In conclusion, by performing an in-depth analysis using these various strategies and tools, investors can make an informed prediction of when a pullback may be over, maximizing potential returns from trading in the SPY. However, proper risk management should always be at the heart of every decision made.