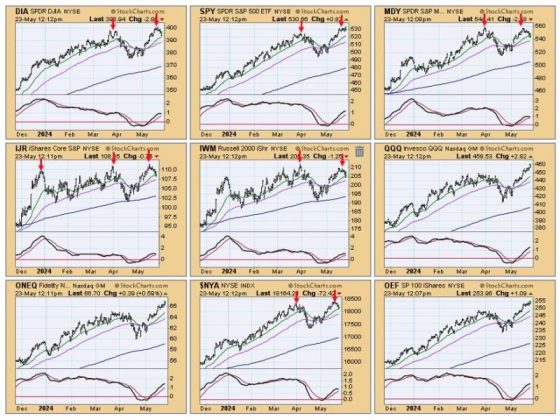

Testing financial waves by technical analysis, one can’t help but notice the fierce volatility that is continuously rocking the Standard & Poor’s (S&P) 500 index. Intriguingly, financial analysts have noted specific indications that the S&P 500 might be setting itself up for a downside target of 4800. This insight is not designed to spread financial fear, but to bring attention to noteworthy movements that could provide guideline for investment strategies.

The S&P 500 comprises some of the largest and most influential companies in the United States. Hence, it is regarded as an effective barometer of both the U.S. stock market and the overall economy. Some of the main pointers leading to the downside target of 4800 include the main elements such as exhaustive rallies, an overstretched market, a rotation out of growth stocks, increasing inflation and rising interest rates.

A common concept in financial markets is that what goes up must inevitably come down, at least for a bit before continuing on its upward trajectory. This is where exhaustive rallies come into play. Recently, the S&P 500 has seen several of these rallies, which are usually followed by rapid pullbacks. These pullbacks can be seen as a market correction essential to bring equilibrium to prices.

Next, the overstretched market is beginning to show its strain. With the S&P 500 at all-time highs, investment analysts warn that we are in an overbought market state where quite a few companies are trading at prices above their inherent value. Such situations are generally followed by a necessary correction, targeting lower levels.

Moreover, a significant rotation is being noticed out of growth stocks and into value stocks. As the market attempts to look for stability, investors regard value stocks as a safe haven amidst this uncertainty. This shift could potentially lead to lower levels of indices dominated by growth stocks, such as the S&P 500.

Inflation is another key player leading to a potential downside target. It has been on the rise, tested by the effects of unprecedented fiscal stimulus, supply chain disruptions and labor market shifts. Inflation leads to higher interest rates, which affect companies’ borrowing costs, subsequently impacting their profits. This dynamic could be detrimental to the S&P 500 levels.

Finally, rising interest rates are one of the significant factors that could contribute to hitting the target. The Federal Reserve is expected to raise interest rates in the coming months to curb the impact of inflation, making borrowing expensive. This situation tends to decrease the appeal of stocks, pushing investors toward safer asset classes such as bonds.

Investors should carefully watch these potential markers, along with the S&P 500’s tendency to break critical support levels. While the downside target of 4800 may seem alarming, it could also serve as a time for investors to assess and adjust their strategies, rather than react with panic. After all, price corrections bring valuation equilibriums and present opportunities for investors to hop on the bus at more affordable fares.

Ultimately, the trajectory of the S&P 500 will depend on a confluence of factors. These include earnings outcomes, policy decisions by central banks, geopolitical tensions, and macroeconomic datas. Being aware of the downside target and the factors that could lead to it will allow investors to be more prepared and make informed decisions.+