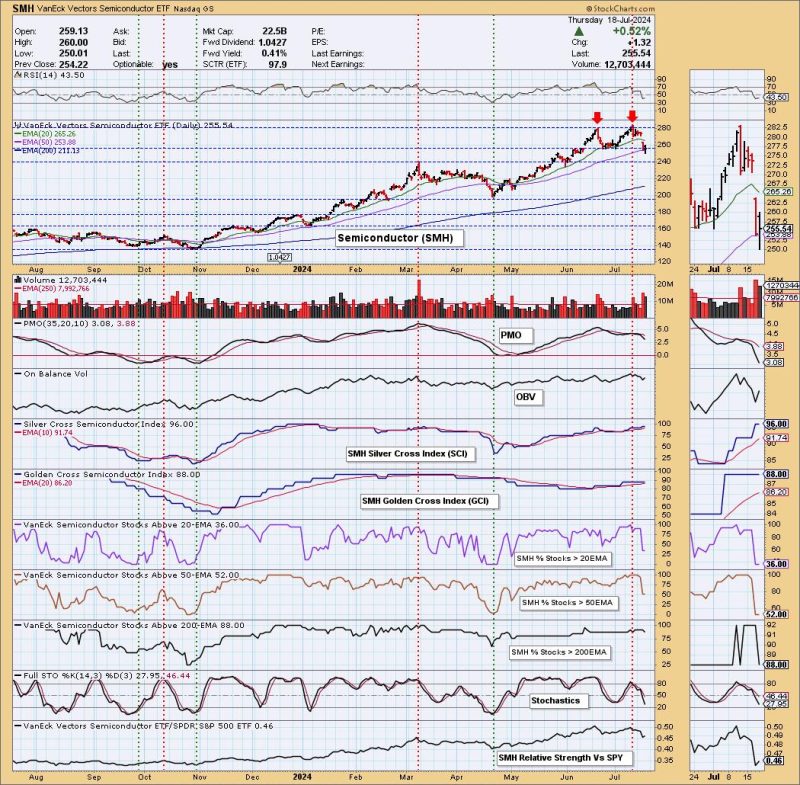

The Double Top is a crucial chart pattern frequently observed in stock analysis, commodity trading, and notably within the realm of semiconductors. The SMH, or VanEck Vectors Semiconductor ETF, is not an exception to this dynamism, and the pattern of the Double Top has been realized multiple times. Understanding the mechanics of the Double Top within this specific asset class offers insightful impressions for both traders and investors.

A Double Top pattern, in technical analysis, pertains to a trend where the price of an asset, such as the SMH, reaches two consecutive highs with a moderate decline between the two peaks. The formation is characteristically M-shaped, signifying a bearish outlook when it emerges. Basically, it signals a probable reversal in a previously upward trend, forecasting price levels may soon start to fall.

The first top signifies the climax of the uptrend where prices are driven by enthusiastic buyers willing to pay higher prices. The intermediate trough occurs when sellers manage to pull down prices due to overbought conditions but subsequently, buyers make one more push, forming the second top. If the buying pressure fails to surpass the first peak, then a Double Top is firmly in place.

However, the pattern doesn’t fully confirm until the price falls below the support line, which is traditionally drawn connecting the lowest points of the intermediate trough. At this juncture, it is assumed that the trend could dramatically reverse, creating selling opportunities.

When this pattern applies to semiconductors specifically, the implications can reverberate through the technology sector as a whole. SMH, holding companies such as Intel, Nvidia, and Taiwan Semiconductors, is very representative of this sector. A bearish outlook on SMH might thus be interpreted as a bearish outlook on the technology sector entirely.

Among the past instances of a Double Top in SMH, a notable illustration occurred in early 2020. The price reached a peak in late February, then fell drastically and reached a peak once again in early June. Prices never exceeded the February level, thus establishing a Double Top pattern. Eventually, the ETF’s price did descend, affirming the forecast of the bearish trend that was anticipated by the pattern.

The role of volume in the formation of Double Tops should also not be overlooked. Volume can often increase during the formation of the first peak and diminish during the formation of the second peak, indicating declining momentum and a possible trend reversal. This behavioral pattern of traders, visible through volume, can provide additional confirmation of the pattern.

In conclusion, recognizing and understanding Double Top pattern, specifically when analyzing ETFs such as SMH, is a powerful tool for market participation. Through recognizing this pattern, investors can obtain a better understanding of the market and can make informed decisions about when to buy or sell. With its innate capacity to foretell potentially significant trend reversals, the Double Top remains a crucial element to consider when delving into semiconductors trading.