The iShares Russell 2000 ETF, commonly known to investors as IWM, has been a topic of discussion among industry experts, with many considering it as an important instrument for diversification. This article analyses whether it’s time to purchase IWM as small-cap stocks appear set to soar.

Over the last couple of years, IWM has caught the attention of diversified portfolio managers due to its potential for increased returns. IWM provides exposure to small-caps, which refers to companies with market capitalization ranging from $300 million to $2 billion. These companies are regarded as high-growth but high-risk due to their relative instability, making them perfect for adventurous investors in possession of a comprehensive risk management strategy.

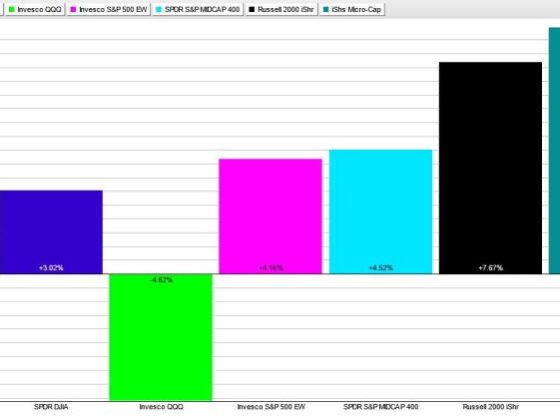

One compelling reason to consider buying into IWM now is the recent trend of outperformance by small-cap stocks compared to their larger counterparts. The Russell 2000 index has witnessed a significant surge, outstripping the S&P 500 and reframing the narrative in a way that is advantageous to small caps. With investors’ rising appetite for risk, the trend seems likely to continue.

IWM also experiences spontaneous rotations fuelled by macro-economic factors apart from its organic growth potentials. For instance, the arrival of the COVID-19 vaccine has led investors to jump ship from large-cap to small-cap stocks, a move driven by the expectation that smaller companies will rebound faster and more dramatically. As sectors like travel, leisure, and hospitality—areas dominated by small-cap companies—recover from the pandemic, the IWM seems poised for significant growth.

Furthermore, the Biden administration’s commitment to infrastructure development potentially sets the stage for the surge in IWM. Many small-cap companies will directly benefit from the infrastructure bill, and if the proposed legislation becomes law, they stand to receive multi-year funding for various projects. This prospective boom provides another reason why now might be the ideal time to buy IWM.

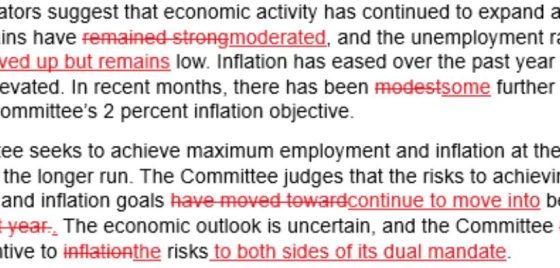

The Federal Reserve’s monetary policy also influences IWM’s allure. With the low-interest-rate environment expected to persist, small-cap stocks could continue to outshine, as they traditionally do well during such periods. Meanwhile, the Fed’s pledge to keep a steady hand until the economy achieves full employment and inflation hits 2% can further enhance the demand for small-cap equities, thus promoting the reason to invest in IWM now.

However, any potential investors should consider the risks associated with investing in small-cap stocks. They tend to perform poorly during economic downturns due to their high volatility, and they may take longer to recover than larger firms. Furthermore, they may not pay dividends, which can hamper cash flow for investors who rely on income from their investments.

In conclusion, while the current market situation offers compelling reasons to consider investing in IWM, each investor must assess their risk tolerance, investment objectives, and overall portfolio strategy. As always, a balanced and well-researched approach to investing offers the greatest chance of success. The small-cap market’s inherent volatility demands careful consideration and planning by prospective investors before making any decisions.