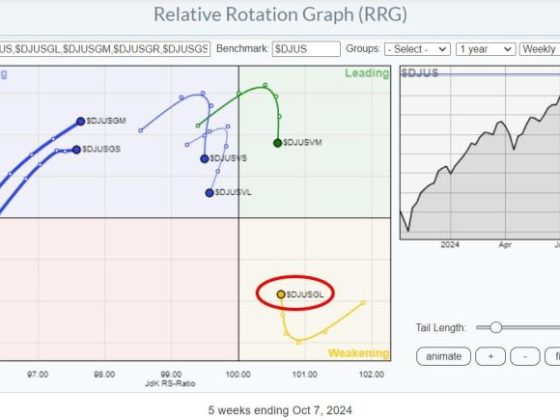

While the media is abuzz with the news of major market indices repeatedly scaling fresh all-time highs, there is a significant underperformance that fails to grab equally compelling attention – the small-cap stocks’ lackluster participation in this bull market. Notably, these market minnows have been mostly outpaced by their more substantial counterparts, raising question marks on the overall breadth and depth of the market.

Small-cap stocks, typically seen as the pulse of the domestic economy, are showing signs of distress. These stocks, given their domestic orientation, are often regarded as the litmus test of the economy. However, their exclusion from the new all-time high celebrations largely indicates that economic growth, though undoubtedly present, lacks comprehensiveness.

The Russell 2000 index, a popular gauge for small-cap performance, has notably lagged the S&P 500 this year. Despite the optimism surrounding the economic rebound, the Russell 2000 index is trailing, indicating a disparity in the market’s bullishness. This divergence suggests that the current bullish run’s breadth is far from perfect, leading analysts to question if the all-time highs of the broader indices represent a true reflection of the overall market health.

This lack of participation could be attributed to several factors. Firstly, inflation concerns might be more pronounced for smaller firms that have limited pricing power. Secondly, a possible increase in corporate taxes and higher regulatory scrutiny are major headwinds for small-cap stocks. The speculation around the Federal Reserve’s probable tightening of monetary policy adds to these worries. Lastly, these are the stocks that tend to be more volatile and, in turn, more adversely affected during market uncertainties.

Bifurcation in market behavior also shows polarisation in investor sentiment. Money appears to be chasing fewer larger names in the technology, communication services, and consumer discretionary sectors, which include mega-cap stocks like Amazon, Apple, and Google, that have contributed significantly to S&P 500’s milestone march. This concentration of wealth in a small subset of the market pushes total market cap higher, despite more vast portions sitting out in the all-time high party.

An underperforming small-cap index amidst all-time highs in broad market indices could also be a sign of frothiness in the market. It sends a warning signal that the rally might be over-extended and due for a pullback, making small-cap underperformance a significant factor to watch.

While this is not to spread pessimism or prophesize doom, it helps to maintain a balanced perspective. Investing is as much about identifying opportunities as it is about being aware of risks. As market participants, it’s crucial to keep an eye on diverse market indicators, including small-cap performance.

In conclusion, the ongoing situation in the stock market where small-cap stocks are not participating in new all-time highs presents a unique paradox. This underperformance could be an early caution that changes might be brewing underneath what seems like an unstoppable march towards new records in equity markets. Investors and analysts should tread carefully, taking note of this anomaly, as it might have implications for the broader financial ecosystem.