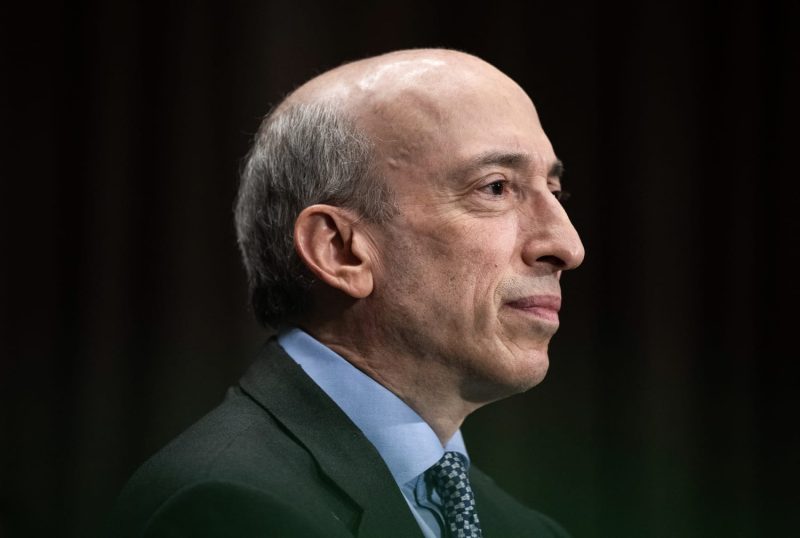

In a surprising move, Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), has recently announced his decision to step down from his position beginning January 20. His departure paves the way for a potential replacement from former President Donald Trump’s administration. This change in leadership could have significant implications for the regulatory landscape of the securities market.

Firstly, under Gensler’s stewardship, the SEC had taken several steps to tighten controls on Wall Street. He was instrumental in implementing policy safeguards to enhance investor protections, improve market integrity, and promote competition. He led crucial reforms in the aftermath of the 2008 financial crisis and was known for his proactive stance on issues ranging from climate change and corporate accountability to cryptocurrencies. Gensler’s departure would certainly mark the end of this regulatory era.

However, this vacuum also presents an opportunity for a new era in the SEC under Trump’s potential appointee. The direction this individual could take the SEC remains uncertain, but if the past is any premise, it is plausible that the new leadership may lean towards a lighter regulatory approach, with increased emphasis on deregulation and market autonomy.

The conventional thinking would posit that someone from Trump’s camp might favor a lower regulatory approach that prioritizes business growth over stringent oversight. This characteristic was a defining feature of Trump’s presidency, with his administration repeatedly taking steps to deregulate various industries, arguing that such moves would stimulate economic growth and job creation.

Nevertheless, this shift may not be without its pitfalls. Some analysts argue that relaxation of controls may lead to excessive risk-taking behaviours from Wall Street, potentially making the financial system susceptible to market shocks. This concern is particularly salient given the increasing sophistication and interconnectedness of the financial markets.

There is also the issue of cryptocurrency regulation, a matter that Gensler has been very vocal about. If Gensler’s successor takes a more lenient approach towards cryptocurrencies, this could mark a significant change in policy direction. Given the meteoric rise of crypto-assets and their potential systemic implications, the next Chair’s stance on this subject will be keenly followed by industry players and regulators worldwide.

Would Wall Street greet deregulation with relief, or would it undercut investor confidence? How would policymakers react to a less stringent oversight of cryptocurrency? These questions resound as markets prepare for transition.

While the identity of Gensler’s potential replacement is yet to be declared, the person who fills these shoes will undoubtedly have a significant role in shaping the future course of not just the SEC, but also the U.S. financial markets at large. As we mark an end to an era with Gensler’s departure, we also anticipate a shift in policy direction, the implications of which remain to be seen.