Over recent years, small-cap stocks have frequently been in the limelight due to their surprising breakout performances. Their bullish run on the stock market has left many investors amazed and optimistic about their potential. This article will examine the key reasons behind these bullish breakouts and assess the potential benefits for investors willing to take calculated risks.

To begin with, it’s imperative to have a clear understanding of what small-cap stocks are. They represent shares of public companies with a market capitalization (total market value of its outstanding shares) typically ranging between $300 million and $2 billion. While they may not generate as much publicity as their large-cap counterparts, small caps can offer investors robust returns.

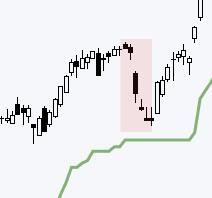

A primary reason for the bullish breakout of small-cap stocks lies in their inherent nature. These stocks are typically from emerging companies or sectors that possess a higher risk but equally optimal growth potential. The promising growth opportunities often provoke a bullish trend and trigger a breakout. For instance, many small-cap companies have been at the forefront of breakthroughs in areas like technology, blockchain, pharmaceuticals, or renewable energy. Their innovation and adaptability to market changes create significant value-add for investors.

Another critical factor that fuels the bullish trend of small caps is their correlation with macroeconomic factors. Unlike large-cap stocks, which are heavily influenced by global events, small-cap stocks are generally more correlated with domestic economic conditions. This resilience to global economic turmoil can lead to a bullish breakout, especially during periods of strong domestic economic growth or recovery.

Small-cap stocks also benefit from a lack of analyst coverage, which can lead to undervalued pricing. Due to the limited resources, many small-cap stocks do not receive as much attention from the financial media, institutional investors, and Wall Street analysts as larger companies do. This lack of coverage could lead to pricing anomalies, potentially allowing small-cap stocks to be more undervalued, creating ideal conditions for a bullish breakout.

Additionally, small-cap stocks often benefit from favorable government policies. Governments, particularly in emerging economies, encourage the growth of smaller businesses due to their significant contribution to job creation. Such policies provide ample opportunities for bullish breakouts in small-cap stocks.

However, investing in these stocks is not without risks. The volatility associated with small-cap stocks is usually higher than that of large-cap stocks. Besides volatility, liquidity risks also exist, as finding buyers for small caps can be relatively challenging, given that they are lesser-known among market participants.

Notwithstanding the risks, the bullish breakout of small caps provides an appealing opportunity for investors. It offers a chance to diversify investment portfolios and boost returns significantly. The current financial climate, characterized by lower interest rates and a relatively stable economic outlook, creates a conducive environment for small-cap stocks to thrive. And when they do breakout, small-cap stocks have the potential to generate substantial returns, exceeding the performance of their larger counterparts.

In summation, the bullish breakout of small caps – although mercurial at times – offers an exciting investment avenue with substantial return potentials. While maintaining caution and prudence, smart investors can extract significant value from this vibrant and dynamic segment of the market.