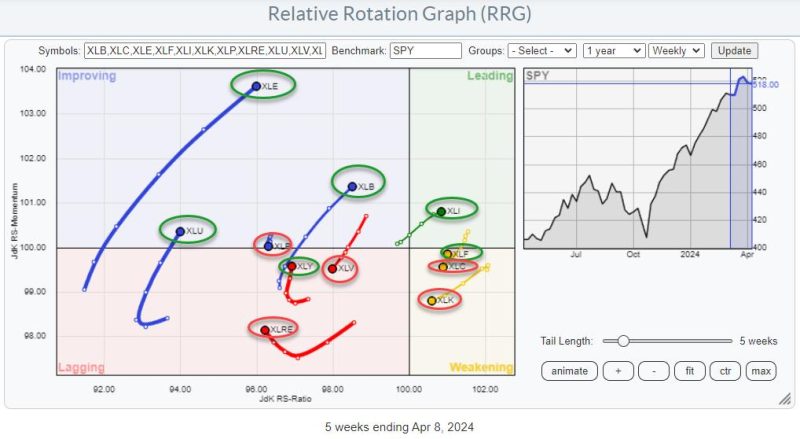

In a rapidly changing technology landscape, the Relative Rotation Graphs (RRG) reveals an intriguing trend: non-mega cap technology stocks are showing signs of improvement. This analysis, derived from measuring the relative strength and momentum of a group of stocks, allows investors to visualize and interpret the market’s direction. The results show a surprising twist in the technology sector.

RRG is an innovative tool utilized by analysts to track the performance of different stock sectors and identify the ones outshining the others. What has grabbed attention recently is the emerging strength of non-mega cap technology stocks that are becoming promising players in the market.

Non-mega cap technology stocks refer to those belonging to the technology sector that are valued significantly less than their mega-cap counterparts. Despite their smaller stature, these stocks have the potential for high returns, especially for investors willing to take on a bit more risk. The latest trend identified by RRG indicates a realignment of power patterns – with non-mega cap technology stocks exhibiting an upward trend.

Previously, technology stocks have been dominated by the likes of Microsoft, Apple, and Google. These tech titans, with their immense market cap, have dictated the rhythm of the market. However, the RRG graphs show a shift in momentum towards non-mega cap stocks. This suggests that the investor sentiment is moving towards greater risk tolerance and variety.

A closer look at the RRG quadrant reveals that a number of technology stocks are traversing from the Weakening quadrant to the Improving one. It means these lesser-known technology stocks are gaining momentum when compared to the broader market index. It indicates that investors are apparently taking note of these lesser-known tech equities, seeing them as appealing investment options.

The chief advantage of investing in non-mega cap technology stocks lies in their potential for growth. Since these companies are generally at an earlier stage of their business cycle, they have potentially unexplored avenues for expansion. Coupled with innovative technologies and agile solutions, they can afford significant returns to investors.

In addition, the COVID-19 pandemic has accelerated digital transformation across various sectors, leading to increased demand for innovative technological solutions. Smaller tech companies, often more nimble than their mega-cap counterparts, have capitalized on this, coming up with unique solutions to meet the sudden surge in demand.

While the RRG graphs indicate non-mega cap tech stocks’ upward momentum, investors should still exercise caution. Just like any investment, putting money in non-mega cap stocks involves risks with the high possibility of volatility. Thorough analysis and research is necessary before making investment decisions in these stocks.

The RRG’s indication that non-mega cap technology stocks are now in the Improving quadrant means their relative strength is increasing, and they might be moving into the Leading quadrant soon. This suggests that these stocks might outperform the market index in the future.

To sum up, the trends indicated by the Relative Rotation Graphs echo a change in the wind for non-mega cap technology stocks. However, investors ought to adopt a balanced and careful approach while diving into these waters. The crucial aspect remains the need to stay informed and attentive to the ever-changing financial eco-system.