Body:

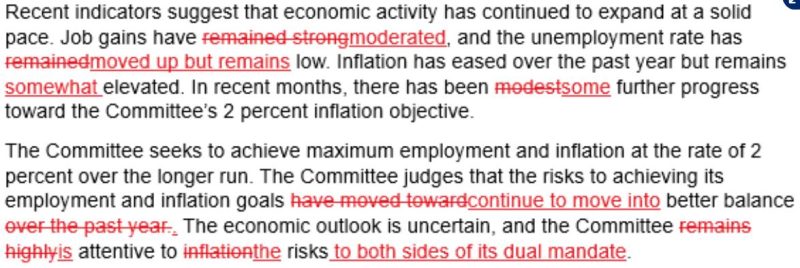

The U.S. Federal Reserve, often referred to as the Fed, has been the subject of much debate and controversy, particularly in recent times. Its actions and policies significantly influence the dynamics of the U.S. and, by extension, the global economy. But, the topic at hand revolves around the assertion that the Fed is single-handedly creating its worst nightmare and, in the process, unknowingly maneuvering the public into puppet-like roles.

Primarily, the Fed adopts a complex set of monetary and fiscal policies that impacts the U.S. economy at large, which automatically leaves the public on the receiving end. Among its many duties, the pursuit of stable prices, moderate long-term interest rates, and maximum employment are key. However, its recent policies – notably, the lowering of the interest rates and the initiation of quantitative easing – are provoking unforeseen consequences.

Low interest rates – though they may encourage consumers to borrow and boost spending in the short term – have caused concerns. Lowering interest rates has led to an increase in borrowing which, when used for consumption or unproductive investment, increases debt and creates asset bubbles, housing market crises, and even recessions. This not only disrupts the balance of the economy but also engenders an unnerving level of unease among the public, reducing their faith in the economy and creating a mentality of fear and scepticism.

Quantitative Easing (QE), which essentially is an unconventional monetary policy used by the Fed to stimulate the economy when standard monetary policy has become ineffective, is another tool that has come under scrutiny. It involves the purchase of long-term securities from the open market to increase the supply of money and encourage lending and investment. QE indeed had temporary benefits following the 2008 recession, but it is also blamed for inflation and asset bubbles. In essence, such a policy can play the role of an economic puppeteer, tweaking the system and playing with people’s lives for the benefits of balance sheets rather than individuals.

On the back of such monetary strategies, the Fed is arguably stirring a dangerous cocktail of debt and distrust, making it its own antagonist. In their pursuit of managing the economy and warding off financial crises, these policies have sometimes stirred more uncertainty and mistrust among the public.

Lastly, the public often ends up in the role of the puppet, bearing the brunt of these economic policies. We are the ones subject to the instability and unpredictability that come with lowered interest rates and excess printing of money. Our lives are deeply intertwined with the economic decisions made by the Fed, bound by their consequences and left to navigate a landscape they’ve shaped. While we may have the option of voicing our opinions on these matters, ultimately, it is the puppet masters – the policy makers – who pull the strings, often manipulating the entire economic scenario at their will.

In conclusion, by implementing policies that may appear beneficial in the short-term but prove destructive in the long run, the Fed creates its own nightmare, and, unknowingly or not, the people are turned into unwitting puppets. An entity that’s designed to catalyze economic stability and growth is arguably precipitating a contra effect, highlighting a paradox that needs to be addressed with urgent attention and sincere efforts.