As the Federal Reserve slashes interest rates, the stock market, in a remarkable last-minute turn, jumps and dives with an unpredictable ebb and flow that characterizes the financial world’s response to this economic development.

The Federal Reserve, in a move to offset potential economic setbacks and promote financial stability, declared a reduction in interest rates. The rate cuts are a monetary policy instrument the Fed uses to stimulate economic activity, primarily when there’s a fear of recession. By reducing borrowing costs, the Fed encourages commercial banks to loan more, thereby facilitating consumer and business spending which, in turn, helps stimulate the economy.

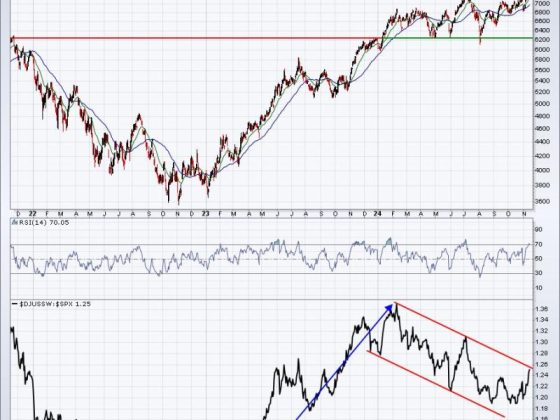

After the announcement from the Federal Reserve, the stock market experienced a sudden upheaval, reversing its downward trend and skyrocketing upwards. Investors keenly watch out for Fed decisions as they can significantly influence the stock market. Lower interest rates often mean increased borrowing and spending, which can translate into higher corporate profits and a resultant surge in stock prices.

However, it’s also crucial to highlight that the relationship between interest rates and stock markets is not always straightforward. Lower interest rates can cause a worrisome increase in borrowing, potentially leading to significant financial instability if stocks do not perform as expected.

The abrupt U-turn in the stock market also underscores the volatile nature of the financial sector and its sensitivity to macroeconomic indicators and policy changes. The often knee-jerk reaction of the market is reflective of investors’ sentiments that directly respond to such economic news.

With the rate cuts, sectors that thrive on borrowing are likely to benefit the most. These include real estate, automobiles, and consumer durables which are often bought on credit. In contrast, sectors like banking may experience a hit due to a squeeze on their net interest margins. Therefore, while the overall market reacts positively to the rate cuts, the response within different sectors may vary significantly.

The Fed’s move to cut rates also holds considerable implications for individual investors. With lower interest rates, bonds and fixed deposits yield significantly lower returns, pushing investors to explore other higher-risk, high-return investment avenues such as the stock markets. This surge in investment further helps drive up stock prices―a ripple effect that started with the initial rate cut.

Yet, the stock market’s peculiar U-turn indicates the short-term nature of this effect. The euphoria surrounding rate cuts may drive stock prices up momentarily, but other factors such as corporate earnings, inflation, and overall economic health inevitably come into play. As the market digests the implications of the rate cut, it may experience another shift, making it crucial for investors to have a balanced, diversified portfolio to weather such volatility.

In summary, the Fed’s decision to slash interest rates has had an immediate and remarkable impact on the stock market, leading to an unexpected U-turn in its trajectory. Despite the initial cheer from investors, market fluctuations reaffirm the need for a cautious and well-considered investment strategy. With the economic landscape continually evolving, market participants must stay alert to further developments stemming from such policy shifts. After all, navigating the intricate maze of the stock market requires not just knowledge of rates and returns, but a keen eye on the broader economic activity.