Understanding the ADX Indicator

The Average Directional Index, commonly known as the ADX, is a technical analysis tool created by Welles Wilder. It’s primarily used to measure the strength and direction of a trending market. Noticeably, the ADX does not specify the direction of the trend; it simply quantifies the strength of the overall movement, irrespective of whether it is up or down.

Measuring Trend Strength

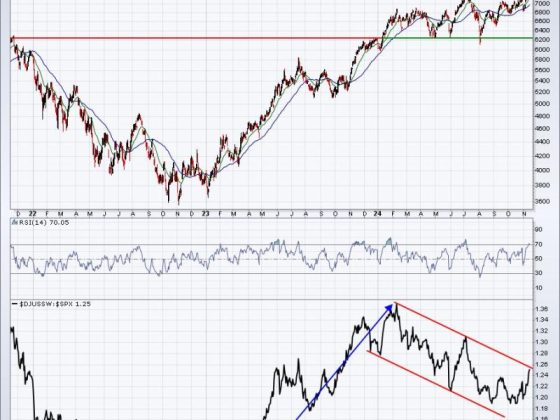

Firstly, the strength of a trend is quantified on a scale of 0-100, and it doesn’t provide information about the trend direction. A value less than 20 typically indicates a weak trend, while a value over 50 signals a strong one. This differentiation helps traders identify whether they are in a ranging or trending market. However, the core role of ADX as a trend strength indicator is not its absolute value, but the value in relative terms over time.

Understanding ADX Components

The ADX is derived from two other indicators, namely the positive directional indicator (+DI) and the negative directional indicator (-DI). The +DI measures the force of the upward moves, while the -DI measures the intensity of the downward moves, over a specified period. When the +DI is above the -DI, it indicates an overall uptrend, and when the -DI is higher, it corresponds to a downtrend. Together, these form the Directional Movement System, which measures the ability of bulls and bears to move price beyond yesterday’s trading range.

Applying the ADX Indicator

To apply the ADX indicator in your trading platform, follow these steps: access the indicators tab, search for the ADX, and add it to your chart. As the ADX rises, it signals that the trend is gaining strength. Conversely, if the ADX starts to decline, it’s an indication that the trend is weakening and could possibly be reversing.

Interpreting ADX Values

Here’s a brief overview of interpreting the ADX values:

1. 0-25 – Absent or weak trend

2. 25-50 – Strong trend

3. 50-75 – Very strong trend

4. 75-100 – Extremely strong trend

Remember, the ADX doesn’t imply the trend direction; it just shows its strength. To determine the trend direction, use the +DI and -DI.

Using ADX with Other Indicators

Wilder suggests that the ADX should ideally be used in conjunction with other technical indicators. The reason being, while ADX helps determine the strength of the trend, it lacks the capability to indicate the trend direction. For example, using ADX with moving averages can be beneficial. When the ADX is rising, and the price is above the moving average, it signals a strong upward trend.

In Summary

The ADX is a powerful tool for traders in the financial market. It may sound a bit complicated initially, but with practice and experience, it can help you distinguish between strong and weak trends. However, like any other indicator, it’s not foolproof and should be used in conjunction with other tools in your technical analysis toolkit for making informed trading decisions. Additionally, always remember to consider the risk management aspect in all your trading pursuits.