Today, we find ourselves diving into the realm of advanced analytics in the bustling world of financial markets: Signal Scoreboards. Specifically, we explore the premise of the Signal Scoreboard being as good as it gets.

The world of financial analytics has seen a massive revolution in its frameworks, tools, and interpretation over the years. Among these myriad advancements, one of the most remarkable has been the advent and evolution of Signal Scoreboards. These intricate tools, used for both stock and currency trading, serve as in-depth statistical analyses to predict future price movements.

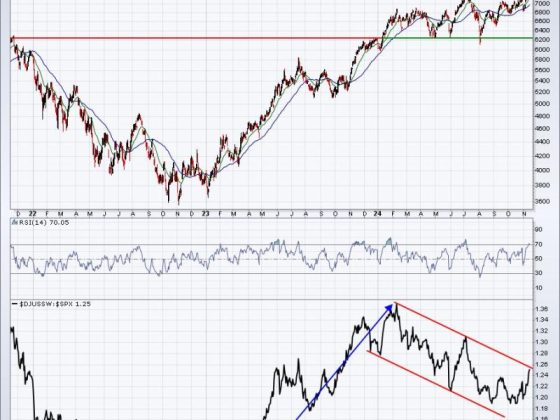

A Signal Scoreboard consists of a series of precise and detailed algorithms that compute and provide financial data in a format that can be readily understood by traders and market analysts. It takes into account various technical indicators and economic factors such as moving averages, relative strength index (RSI), volume and volatility, and even considerations from macroeconomic indicators like GDP growth, inflation rates, among others.

The advantage that sets Signal Scoreboards apart is this amalgamation of diverse analytical tools into a single, cohesive interpretative framework. In an ecosystem as dynamic and complex as financial trading, speed, and accuracy are of the essence. Signal Scoreboards add value by offering an aggregated analysis, thus saving time and resources by eliminating the need to manually collate individual indicators.

Moreover, Signal Scoreboards allow traders and analysts to scan whole sectors, benchmark indexes, or specific stocks for particular patterns or signals. It affords professionals the ability to see through the noise and identify crucial patterns previously undetectable by the human eye.

A key attribute of Signal Scoreboards that deserves mention is their adaptive nature. In an industry characterized by continually evolving market patterns, fluctuations, regulatory regimes, and disruptive technologies, the need for a forecasting tool that morphs as quickly is paramount. Signal Scoreboards, with their machine learning and artificial intelligence capabilities, can adapt to and predict changing patterns, thus providing a more accurate, timely analysis.

However, as with any analytical tool, it is important to be wary of over-reliance. Signal Scoreboards are as accurate as the data they’re fed and the algorithms they use. In scenarios where market sentiment is driven by unforeseeable factors – the announcement of a sudden policy change, for example – the Scoreboard may not always provide an accurate prediction.

Even considering these caveats, it is without a doubt that the integration of signal scoreboards in financial trading is a game-changer. The combined utility of real-time analytics, predictive modeling, machine learning, and artificial intelligence, in an easy-to-interpret format makes it an unprecedented tool in the trading sector.

Given the constant evolution of the financial landscape merged with technological advancements, Signal Scoreboards stand as giants in the field of financial analytics. They embody the pinnacle of synthesized information, real-time examination, and powerful prediction capacities. Hence, they aptly earn the moniker of being as good as it gets.

In conclusion, while financial markets continue to dance erratically to their discordant tunes, Signal Scoreboards remain at the forefront as steady, reliable conductors, ensuring we do not miss a beat in the symphony of trading. While no tool is perfect, the Signal Scoreboard rightly reigns supreme, owing to its precision, dependability, and innovative adaptability.