The spectacular journey of AppLovin and its exceptional financial performance recently has become a point of significant discussion in the world of stock trading. Rising astoundingly by 1303%, the story of this mobile ad platform’s growth offers intriguing insights into the hidden power of the SCTR Report.

AppLovin, a leading platform that provides developers with a toolset that enhances their apps’ global discovery, engagement, and monetization, has seen exponential growth in its stock value. The stock, trading under the ticker APP, experienced a 1303% rise, adding thumb-stopping value to the company in the stock market. This remarkable growth speaks volumes teaching tangible lessons to the investors about stock selection, timing, and market conditions.

The myriad factors that contributed to this stellar rise could be anything from strong financials, business growth, effective leadership, product excellence, and market trends. However, to decipher the exact answers, we must turn to the StockCharts Technical Rank (SCTR) Report, a robust tool that aids investors in identifying and analyzing the relative strength of a stock, offering a broader perspective to understand stock’s performance.

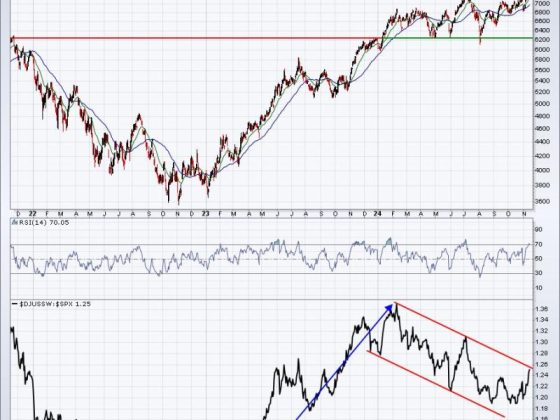

The SCTR report provides a comprehensive yet straightforward way of analyzing stocks, ETFs, and indexes, grading them based on six key technical criteria, including the momentum, volatility and, long and short term performance. Unlike other ranking systems, SCTR uses a uniquely weighted methodology that prioritizes long-term momentum and trend strength. This approach warrants that only the strongest stocks make it to the top, offering investors a clear advantage.

Analyzing the APP’s SCTR report gives a clear image of the stock’s innate strength and its potential of outperforming the market. The algorithm used in the SCTR identifies the powerful growth signals of AppLovin. Furthermore, it sheds light on the stock’s extraordinary potential for high growth, generating soaring returns for its shareholders.

A noticeable trend in the SCTR report was the incredible long-term momentum of the APP stock. This increasing momentum was a strong indication of the company’s consistent high growth and its robustness against the volatile market conditions. AppLovin’s ability to maintain stable financial health amidst the dynamic market environment was a vital factor contributing to its massive stock rise.

Another factor was the low volatility of AppLovin’s stock, suggesting its ability to withstand market jitters. By maintaining a consistent price trajectory in the face of market unpredictability, it remained an appealing choice for investors, therefore adding to its value.

Finally, the short-term performance of AppLovin, as indicated by the SCTR report, gave a more precise impression of the stock’s strength. The APP stock displayed a strong bullish behavior and highlighted a high probability of delivering remarkable performance even in the uncertain market situations.

In conclusion, AppLovin’s spectacular 1,303% rise isn’t just evidence of its intrinsic potency; it is an affirmation of SCTR’s efficacy in identifying potent stocks based on multiple parameters. Using the report successfully and understanding its core signals can provide investors with a significant edge. AppLovin’s rise, as phenomenal as it is, stands as a textbook case of how to effectively use comprehensive tools like the SCTR report to identify potential stock market winners.