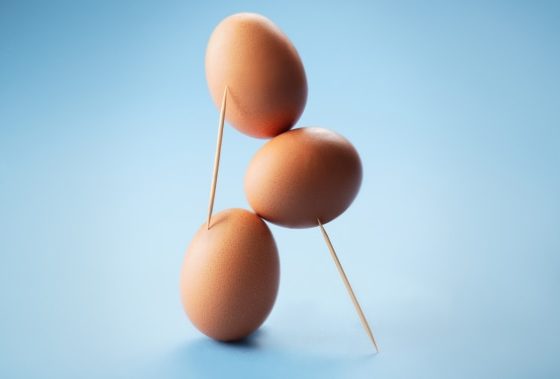

Today, the prices of homes are higher than ever while interest rates in many parts of the world remain near historic lows. This has caused many people to question whether buying a house is still financially beneficial, considering that most have already maxed out their savings and have lesser money to spare. Despite the high prices and interest rates, buying a house can still be an excellent financial decision for certain individuals, as long as it is done correctly.

For someone who is planning to stay in one area for a significant period of time, buying a house might be the right option since it will slowly turn into a long-term savings account. As you make regular payments, your house will eventually gain equity, which you can access when it comes time to retire. Real-estate prices tend to rise over the years as well, so you’re likely to make a nice return on your investment if you wait long enough.

Plus, mortgage rates remain incredibly low, meaning you’ll be able to take advantage of affordable monthly payments. You’ll also be able to deduct the mortgage interest on your tax returns, leaving you with additional money each year. This lowers the overall cost of owning a house in the longer-term outlook.

Of course, it is important to consider all of the costs associated with buying a house, such as down payments, closing costs, and more. You must also make sure that you are comfortable taking on the risks involved in home ownership. But for those who have already decided that they want to own a house, buying one can still be financially beneficial since the present conditions of low interest rates and rising home prices mean that you can make a substantial long-term return on your investment.