Active Investment vs. Passive Investment: The GNG TV Perspective

Body:

When it comes to the world of investing, two main schools of thought dominate – active and passive investing. Through the lens of GNG TV, an outstanding platform for financial news and analysis, we delve into the comparison and insights related to these two investment strategies.

Active Investing: The Daredevil Approach

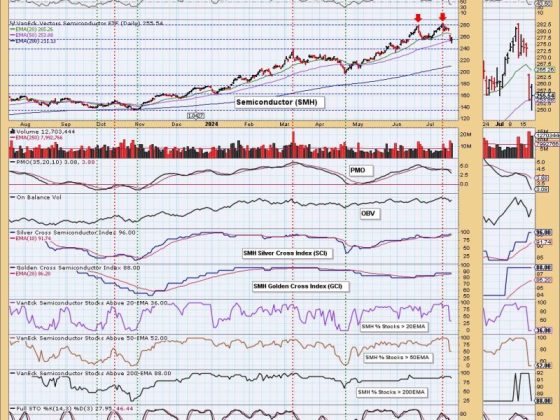

Active investing, as the name suggests, involves hands-on involvement by the investor or appointed financial manager. In this strategy, the investor is continually buying, selling and adjusting their portfolio in a bid to beat the average market returns. GNG TV’s intense investment sector analysis helps active investors to stay updated with the fluctuating market trends.

Active investing necessitates thorough research, fundamental analysis, and financial forecasting to anticipate and exploit market inefficiencies. Active investors are often seeking opportunities to outperform the market and achieve higher-than-average returns. This involves identifying undervalued assets or anticipating market movements, often involving relatively higher risks.

Passive Investing: The Steady Hand

In contrast, passive investing, often likened to a ‘buy-and-hold’ strategy, involves buying a diversified mix of assets with the intent of holding them for a long period. Rather than looking to beat the market, passive investors aim to match the general market performance. Index funds and exchange-traded funds (ETFs) are common instruments used by passive investors.

GNG TV, through its indexed fund tracking and benchmark updates, provides passive investors with the data they need to keep their portfolio in line with market performance. Passive investing is considered lower risk as it follows the view of having a broad market exposure and benefits from long-term market growth.

The GNG TV Factor

For active investing enthusiasts, GNG TV provides indispensable resources such as interactive real-time charts, tools for technical analysis, and updates on market events. They help active investors make informed choices, assess risk, and strategize portfolio adjustments.

On the other hand, GNG TV serves passive investors by giving them updates on broad market indexes like the S&P 500, and sector analyses, which guides them in maintaining the necessary balance in their portfolios.

In terms of costs, active investing tends to involve higher charges, given the frequency of transactions and the need for professional investment advice. Passive investing, however, is a more cost-effective approach as it involves fewer transactions and lower charges. Here as well, GNG TV serves as a guide to navigate these costs, providing a comparison of brokerages and their charges.

Active vs Passive: A Matter of Choice

At the end of the day, whether one chooses active or passive investing depends largely on their investment goals, risk tolerance, and available time for market-tracking. GNG TV offers exclusive content for both types of investors, helping them make the most informed decisions.

The dynamic world of investing doesn’t endorse a ‘one-size-fits-all’ strategy. Some investors may find a combination of both active and passive styles desirable, with a portion of their portfolio aggressively managed, while another portion tracking the market.

Thus, through GNG TV, investors get the exposure to leverage both these investing methods to align with their personal strategy, financial goals and risk appetite to decide where they want to stand in the active vs passive spectrum.