Earnings season is an exciting time for investors and traders. This is when companies reveal their financial performance for the previous quarter, enabling investors to gauge the health and prospects of the companies they’ve invested in. One such company of interest to many investors is NVIDIA Corporation (NVDA), whose recent earnings announcement led to a bullish breakout for its stock that has echoed across Wall Street.

NVIDIA is a California-based tech company that is one of the world leaders in graphic processing units (GPUs). They’re a significant player in this market because GPUs are integral components in a wide range of tech applications, from video games to artificial intelligence (AI). NVIDIA recorded an impressive rally in recent weeks, which can significantly be attributed to its most recent earnings report.

NVIDIA had an impressive third quarter, with record revenues and earning per share (EPS) coming in significantly above analysts’ projections. The company had revenues of $7.1 billion at the end of Q3, representing a year-on-year increase of 50%. Furthermore, adjusted earnings per share were $1.17, beating the analyst consensus estimate of a paltry $1.10.

One of the main drivers behind NVIDIA’s bullish breakout was the company’s data center business. In the third quarter, the revenue derived from this particular sector of NVIDIA’s business surged by an impressive 155%. The data center segment of the business now brings in a larger proportion of total revenues than the gaming sector, which is significant considering NVIDIA’s roots in the gaming industry.

In addition to its data center business, NVIDIA has also shown a strong presence in other industry sectors. Its Automotive division, despite a drop in sales this year due to the global pandemic, has been growing steadily over the years and has demonstrated significant future growth potential due to the rising demand for AI solutions in vehicles and autonomous driving technology.

Furthermore, NVIDIA’s geographic breakdown of its Q3 earnings revealed significant growth in the Asia Pacific region. The company demonstrated enhanced revenue earned from both China and the rest of the Asia Pacific region with revenue increasing YoY by 67% and 47% respectively.

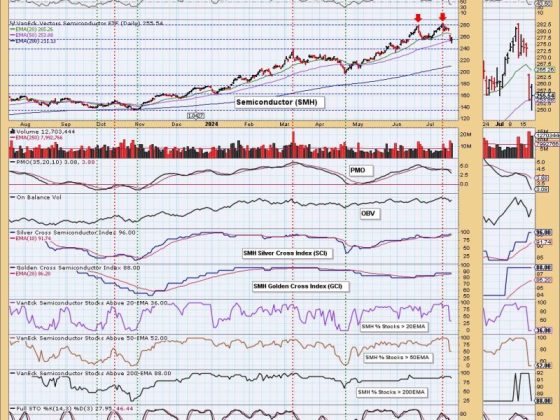

The market responded positively to NVIDIA’s earnings report. It led to a bullish market sentiment with NVDA’s stock price increasing significantly. This even led some Wall Street analysts to label NVDA as a ‘buy’ due to its strong financial performance and the growth sectors that the company has invested in, especially those within the booming tech industry.

Moreover, NVIDIA’s forward-looking statements were also instrumental in its stock’s bullish breakout. This includes the company’s plans to acquire the semiconductor and software design company, Arm Ltd. The acquisition is a strategic move aimed at bolstering NVIDIA’s AI capabilities in the tech industry.

It is fascinating to observe NVIDIA’s success story. Despite the global economic upheaval caused by the pandemic, NVIDIA has demonstrated a robust, resilient, and innovative business model. The company’s strong performance in their third-quarter earnings report, combined with their ambitious growth plans, has driven an optimistic outlook from investors, leading to a bullish breakout in its stock.

More than just the Q3 earnings though, NVIDIA’s performance can also be considered a sign of the broader potential within the tech industry. It is an example of a company that continues to evolve and innovate, remain relevant in a fast-paced industry, and seize growth opportunities.

As we look towards the future, it is clear that NVIDIA is gearing up for accelerated growth. Their foothold in the gaming market, combined with the gradual growth of their data center, AI, and autonomous vehicle sectors, all signify a promising future. Thus, marking a powerfully bullish sentiment that screams across the market. While no investment is risk-free, NVIDIA certainly appears to be an attractive prospect for investors looking for an exposure to the tech industry.