Market Research and Analysis has a broad spectrum of tools and methodologies — one of which is technical analysis. It is an essential part of any investor’s arsenal, helping to decode the market’s behavior and offering insights for investment decisions. This article focuses on why technical analysis is vital in market research and analysis.

Technical analysis is fundamentally a method of evaluating securities by examining statistics generated through market activity, such as past prices and volume. This analysis provides investors and traders with an understanding of the market sentiment, revealing the collective attitudes of the marketplace towards a particular security. Based on this, they can strategize their investment or trading decisions.

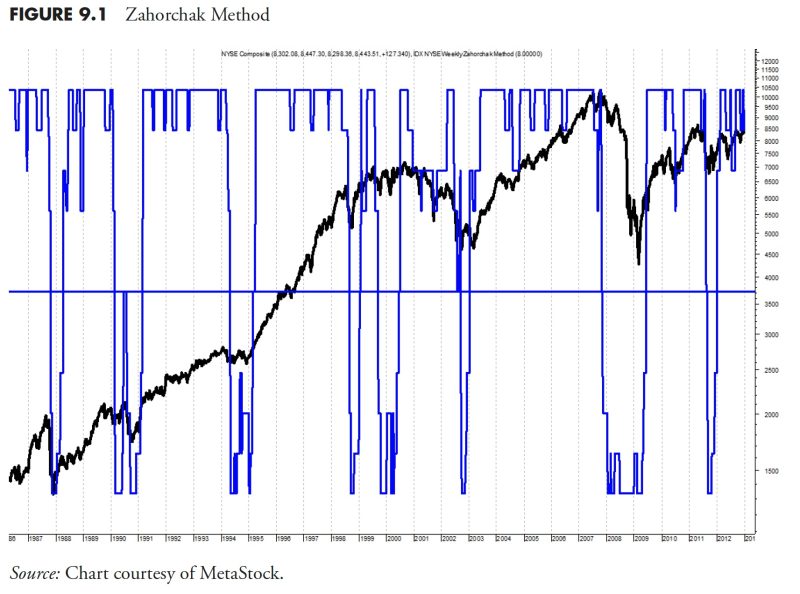

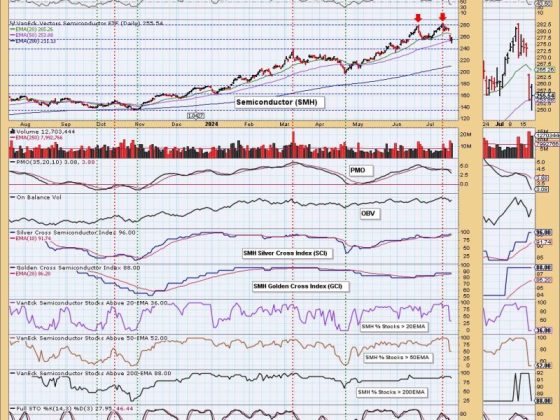

The first key reason why technical analysis is so crucial is that it provides investors with a visual representation of a security’s price movements over a given period. By looking at the stock’s price and volume patterns, investors can predict future price movements. Charts stand as one of the most used tools in technical analysis. Their proper reading can help traders and investors understand whether the market is in a trend phase (either bullish or bearish) or a sideways trading phase.

Secondly, technical analysis helps investors identify numerous market patterns and formations that have been proven to be reliable indicators of future market movements. Patterns such as head and shoulders, double tops and bottoms, and triangles have been studied for centuries and provide a graphical representation of market participant psychology.

Technical analysis also allows investors to identify key market levels, including areas of support and resistance. These levels act as barriers to the price of a stock. Understanding these levels allows investors to strategize their actions, whether to enter or exit a position. Once a price breaks through a key level of support or resistance, major price movements can often be expected.

Additionally, investors use technical analysis for risk management. They can set stop-loss orders based on specific technical criteria to limit their potential losses. This way, if the price moves in an unfavorable direction, the order will automatically be executed, effectively preventing substantial financial loss.

Technical analysis is also unbiased. It solely takes into account the historical price and volume data of a security, irrespective of its fundamentals. Therefore, it facilitates the possibility of making objective investment decisions based on the observable market behavior.

Lastly, technical analysis is adaptable to multiple timeframes. Whether you’re a day trader looking at minute-by-minute changes, or a long-term investor analyzing decades of price history, technical analysis tools can be tailored to meet the needs of any trading or investment strategy.

In conclusion, technical analysis is a critical cornerstone in market research and analysis. It presents numerous advantages, including visual representation, pattern identification, level identification, risk management, impartiality, and versatility in applicability. It’s undeniable that the technical analysis stands as an impactful and reliable tool for any conscientious investor. However, experts recommend using it in conjunction with other methods for a well-rounded analysis and to make more informed decisions. Yielding to its importance, the subsequent efforts should be made to acquire knowledge and skills on using this method effectively to extract its benefits fully.