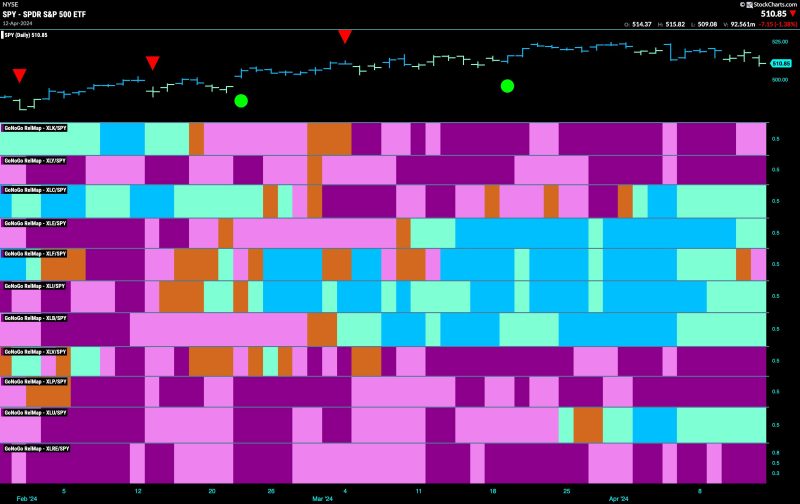

As we delve into the current state of equity markets, it is pertinent to probe the struggles they face in maintaining the promising ‘Go’ trend that has enthralled investors worldwide. Moreover, it is also important to understand the role industrials are playing in this scenario as they attempt to steer the course, advancing forward resolutely.

Primarily, the ‘Go’ trend in equity markets denotes a bullish trend that signifies the market’s positive momentum. However, in recent times, equity markets have been grappling to cling to this trend. This struggle can be attributed to a plethora of factors.

Among the chief reasons is the volatility caused by geo-political tensions and economic uncertainties rife in the current global scenario. These have a direct and profound impact on the performance and overall stability of equity markets. Further intensifying the struggle is the fluctuating market sentiment, which becomes increasingly unstable due to factors like trade wars and currency fluctuations. This causes instability in market trends, making it challenging for the ‘Go’ trend to hold firm.

Additionally, the equity market has been marred by emerging issues such as technological disruptions and stringent regulatory changes. These factors have further complicated the preservation of the ‘Go’ trend, leading to erratic fluctuations.

However, amidst this tumultuous climate, industrials have been trying to lead, solidifying their position as a formidable force. Industries such as manufacturing, technology, and healthcare, have been pivotal in driving up equity market indices, underlining their significant role in fostering market growth.

Industries, particularly manufacturing and construction, have been experiencing an upsurge attributed to robust demand and increasing public as well as private investments. Their activities have a domino effect on associated industries, thereby propelling the overall equity market.

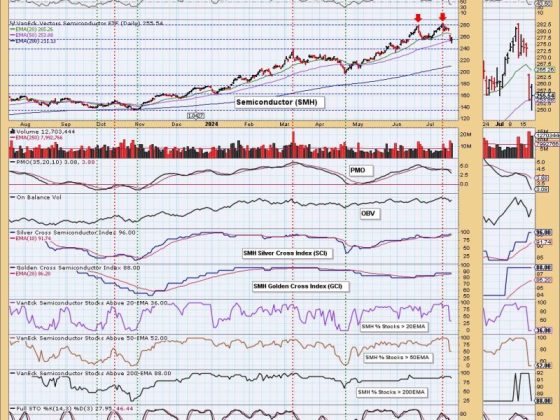

In the tech industry, the embrace of advanced technologies like Artificial Intelligence, Machine Learning, and Blockchain has spurred significant growth, leading to increased investor interest. Healthcare, on the other hand, has shown stable growth backed by aging demographic trends and advancements in medical technology.

However, it’s not all smooth sailing for these industrials as they encounter challenges like increased competition, regulatory changes, and cost pressures. Amidst all this, their endeavor to lead so as to help the equity markets hold onto the ‘Go’ trend is commendable.

As we progress through 2024, trends in equity markets highlight a dynamic environment, one that continues to evolve as it strives to steady the ‘Go’ trend whilst being led by industrials. Be it the struggles and various elements that hinder or the industrials that strive to make it happen, the interplay is fascinating to watch, offering a spectrum of opportunities and challenges alike for investors.

In the end, equity markets aim to hold onto the ‘Go’ trend while industrials strive to lead, painting a testament to the resilient nature of these markets and the tenacity of industrials core to the global economy. The tussle between these two forces will continue reshaping the investment landscape of 2024 and years to follow.