With several indicators flashing in unison, it appears that a stern warning is being sounded for the Standard & Poor’s 500 Index (S&P 500). The charts are increasingly demonstrating signs of a No Go for the index. This article will dive into the specifics of these warnings and provide an analysis on the potential circumstances that investors may find themselves in the near future.

To start with, the completion of a bearish head and shoulders pattern is very significant, and the S&P 500 is currently showcasing this pattern. A head and shoulders pattern is a technical analysis signal that predicts a reversal from a bull market to a bear market. This pattern starts with a high point (left shoulder), followed by a higher peak (head), ending with another high peak similar to the first (right shoulder). The S&P 500 has completed this pattern, thereby raising red flags among keen market observers.

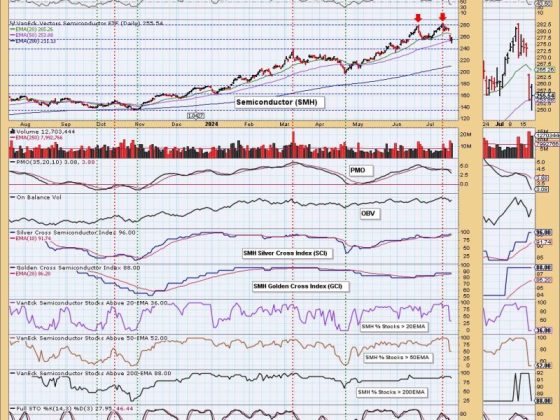

In addition, a crucial technical analysis tool – Moving Average Convergence Divergence (MACD), appears to be signaling bearish momentum for the S&P 500. The MACD, which is a trend-following momentum indicator, shows the relationship between two moving averages of a stock’s price. It offers strong insights about potential reversals and, when it crosses below the signal line, it indicates a sell signal or a bearish momentum, which is currently the case for the S&P 500.

Third is the increased volume on the down days, which has been persistently higher than on the up days. This is indicative of a distribution phase, where large investors are offloading their positions. It’s often viewed as a warning sign that the smart money, or institutional investors, are exiting the market.

Fourth, there is a clear divergence between stock prices and corporate earnings. S&P 500 companies’ earnings have been largely stagnant over the past few years. However, the index has continued to climb, demonstrating a clear divergence. This unsustainable situation where stock prices move higher, while corporate earnings remain static, often leads to heavy corrections in the market.

Lastly, market breadth is deteriorating. This means fewer and fewer stocks are participating in the upward move, leaving the index dependent on the performance of a small group of stocks. This is often considered a sign of weakness for the overall market.

These compelling chart signals align in a way that collectively suggest the S&P500 may not be able to sustain its momentum. The warnings are glaring and investors need to take this as an opportunity to assess their strategies. Risk management, which includes holding a well-diversified portfolio, setting stop-loss orders, and rebalancing portfolios, should be at the forefront of every investor’s planning.

While these chart signals may be clear, it is also important to recognize that markets can remain irrational longer than most investors can stay solvent. Continuing vigilance and thoughtful investment decisions, coupled with deliberated analyses of chart patterns, remain paramount in navigating the uncertain terrain of the financial markets.