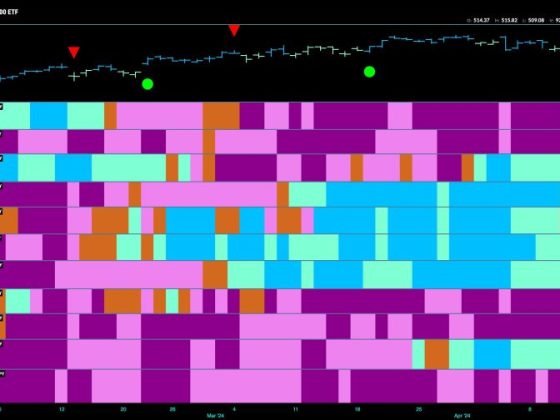

Rocks over Stocks? It may sound like an odd comparison at first glance, but examining this concept more closely offers a unique insight into investment trends and thinking. As investors scramble for the best returns in a volatile market environment, the GoNoGo “heatmap” show prudently pointed out a growing trend of value shifting from the traditional stock markets to hard assets, particularly, precious metals in its 041824 episode.

Commodities are considered the “rocks” in the investment world. Frequently marginalized in the past, commodities have suddenly found themselves in a veritable spotlight as investors are beginning to appreciate their inherent value propositions. The GoNoGo Show 041824 astutely pointed out that commodities like precious metals can offer a strong firewall against problematic market cycles. Their stability can offer a safe haven for investors in times of economic uncertainty.

Gold is one such commodity that has seen an extraordinary boost. When stocks are weak, and the economy is clouded by inflation fears or geopolitical tensions, gold often shines brighter. The reason for this is simple: Gold is a tangible asset, not susceptible to the whims of company performance or market sentiment. Moreover, it is widely recognized as a store of value. This virtue of gold is further magnified in the era of low or negative interest rates or during times of currency devaluation, making it an attractive option for investors seeking to hedge their portfolios against uncertainties.

Silver, platinum, and palladium are other rocks that investors are gravitating towards. While gold might steal the limelight, these other precious metals often offer a higher return on investment due to their wide industrial applications. Similar to gold, these hard assets are often more resilient to drastic economic downturns.

Turning to the stock market, recent trends seem to vindicate the view of moving towards the solidity of rocks. While the stock market has produced significant wealth over the years, its historical volatility can be disconcerting. It is influenced by myriad factors – corporate earnings announcements, changes in fiscal policies, geopolitical developments, and even natural disasters. Thus, the inherent unpredictability of the stock market makes it a risky venture, especially for risk-averse investors or those nearing retirement.

The GoNoGo Show 041824 also underscored the smart move that many investors are making towards commodities EFTs. These are exchange-traded funds that invest in physical commodities like precious metals. They represent an efficient way for investors to gain exposure in the commodity markets without any need to physically store or handle these hard assets. In essence, they provide an easy gate-pass for investors who wish to leverage the stability of the commodities markets.

The GoNoGo Show 041824 also spotlighted the transition to digital hard assets, with cryptocurrencies being the most popular. Though highly volatile, cryptocurrencies like Bitcoin have been dubbed as the “digital gold” due to their scarcity and potential resistance to inflation. Their digitized nature also makes them a modern alternative to the traditional rocks.

In conclusion, the GoNoGo Show 041824 offered a bold perspective – reconsidering our investment strategies and moving from stocks to rocks – hard assets. It emphasized a multidimensional approach to investing where one can still hold equities but calls for diversification into more stable, and potentially safer assets like precious metals. After all, in a volatile market, it’s much easier to sleep on rocks than on a stock market roller-coaster. As the saying goes, sometimes soldiers are better than generals; rocks might just be better than stocks.